Deferred Compensation Maximum 2024. In 2022, only 24% of deferred compensation plans were employer funded. These retirement plans are offered by certain.

What is the 401(k) contribution limit in 2024? The 401 (a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $330,000 in 2023.

Employees Over Age 50 Are Allowed To Defer Up To $30,500.

For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.

These Retirement Plans Are Offered By Certain.

Key dollar limits for retirement benefits and executive compensation to increase for 2024 willkie farr & gallagher llp | willkie.com 2 • the maximum amount.

1 If Annual Compensation Is Less Than The Applicable Limits Shown, Then The Maximum Contribution Is Limited To 100% Of Compensation.

Images References :

Source: www.pinnaclequote.com

Source: www.pinnaclequote.com

Business Life Insurance, The Truth About Deferred Compensation Plans, The maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions. These retirement plans are offered by certain.

Source: xobin.com

Source: xobin.com

What is Deferred Compensation? Meaning, Types and Benefits, The ohio business gateway (obg) allows you to file and pay several payroll withholdings, including ohio deferred compensation. In 2024, employees are allowed to defer up to $23,000.

Source: seniorexecutive.com

Source: seniorexecutive.com

The Basics of Deferred Compensation Plans Senior Executive, Employees age 50 or older may contribute up to an. The 401 (a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $330,000 in 2023.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

What is a Deferred Compensation Plan?, 1 if annual compensation is less than the applicable limits shown, then the maximum contribution is limited to 100% of compensation. The maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions.

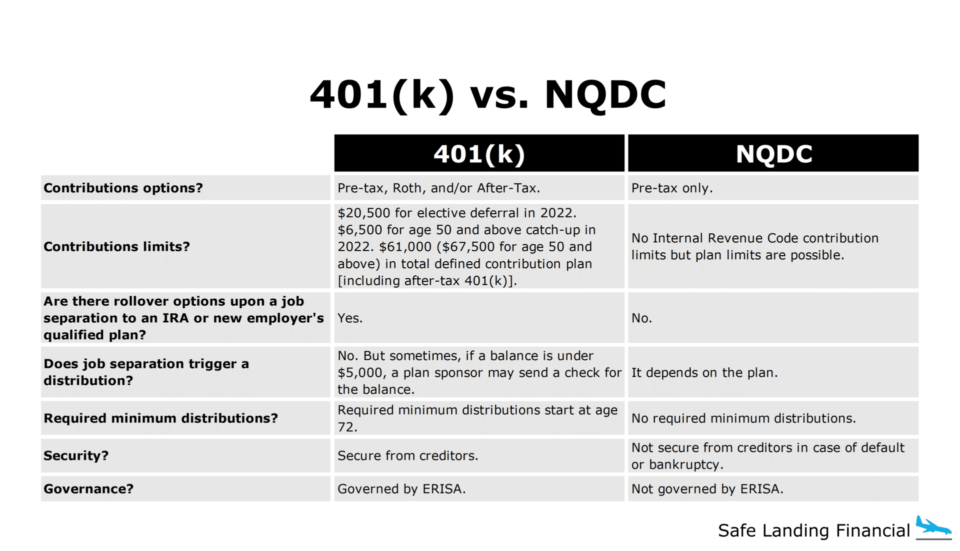

Source: safelandingfinancial.com

Source: safelandingfinancial.com

Deferred Compensation Guide + Case Study, The irs has increased contributions limits for 2024. The annual maximum contribution limits have increased for participants in 457 plans for 2024 due to inflation.

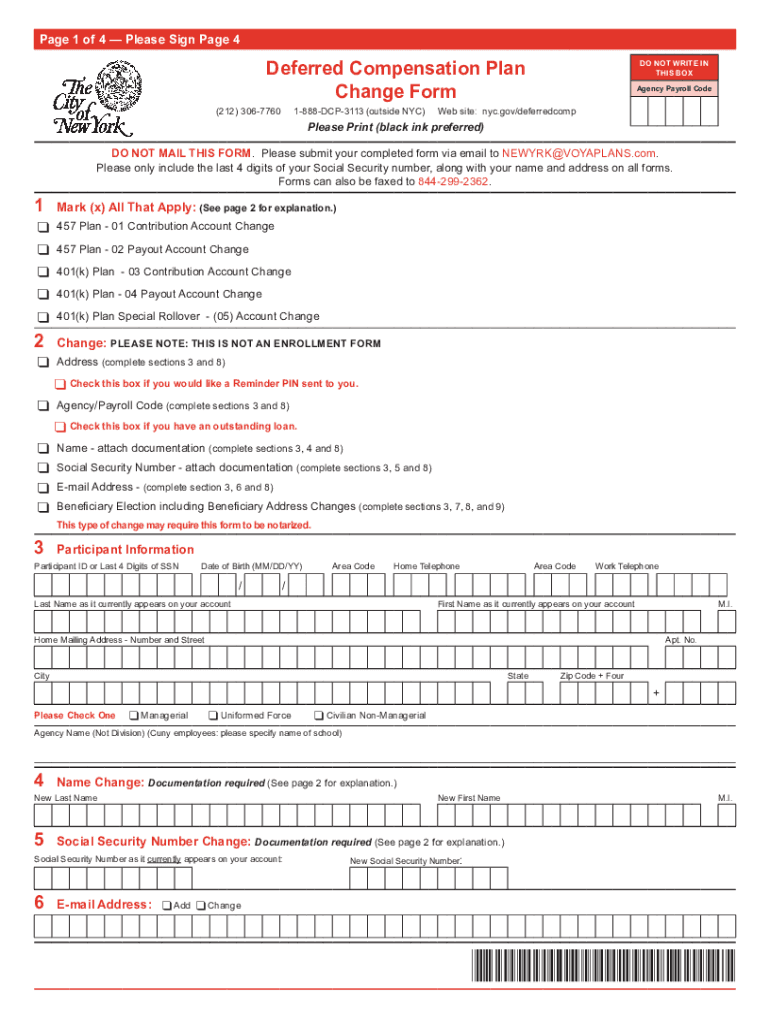

Source: www.pdffiller.com

Source: www.pdffiller.com

20212024 NY Deferred Compensation Plan Change Form Fill Online, 2 if you contribute to a tda, 403(b). These retirement plans are offered by certain.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Deferred Compensation Plans Nonqualified & Qualified Plans, 1 if annual compensation is less than the applicable limits shown, then the maximum contribution is limited to 100% of compensation. The 401 (a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $330,000 in 2023.

Source: theartoffinancialplanning.com

Source: theartoffinancialplanning.com

Deferred CompensationReward Today, Pay Later The Art of Financial, 1 if annual compensation is less than the applicable limits shown, then the maximum contribution is limited to 100% of compensation. The irs has increased contributions limits for 2024.

Source: www.zenefits.com

Source: www.zenefits.com

Deferred Compensation and Its Valuable Role in Total Employee, Key dollar limits for retirement benefits and executive compensation to increase for 2024 willkie farr & gallagher llp | willkie.com 2 • the maximum amount. For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online 457 DEFERRED COMPENSATION PLAN Fax, What is the 401(k) contribution limit in 2024? These retirement plans are offered by certain.

$19,500 In 2020 And In 2021 For.

The maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions.

Employees Age 50 Or Older May Contribute Up To An.

The ohio business gateway (obg) allows you to file and pay several payroll withholdings, including ohio deferred compensation.